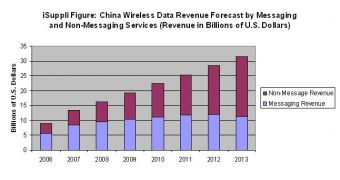

The market of wireless data services in China is expected to see a great growth during the following few years as a result of deployment of the first 3G networks in the country, a recent report from iSuppli shows. The research firm notes that the revenues from these services went up by 18.9 percent in 2009, and that the market should double by 2013, when compared to 2008.

The 3G licenses were awarded about a year ago in China, and the wireless data revenue, including both messaging and non-messaging service, is expected to have increased to up to $19.3 billion in 2009, compared to $16.3 billion registered the year before. However, iSuppli notes that the wireless data revenue in China should reach $31.5 billion by 2013, registering a Compound Annual Growth Rate (CAGR) of 14.1 percent from 2008.

“The rapid growth of China's data services is being enabled by the monumental spending of the nation's wireless carriers on mobile infrastructure equipment,” said Will Kong, an iSuppli analyst covering China. “The carriers this year will spend about $6.3 billion on mobile infrastructure equipment, up 28 percent from 2008. This will represent a near-term peak, with spending in 2010 declining by 2.4 percent to $6.1 billion. During the next five years, carrier spending will continue to decline but will remain at a high level of more than $5.5 billion annually.”

The research firm also states that the non-messaging revenue is expected to exceed messaging revenue due to the fact that wireless operators are beginning to extend the mainstream availability of their 3G services. The non-messaging revenues should reach $20 billion in 2013, up three times when compared to the $6.8 billion registered in 2008.

When it comes to the carriers in the country, iSuppli says that it expects for China Mobile to see slower customer additions, mainly due to an increased competitiveness from China Telecom and China Unicom. The research firm also notes that the two smaller carriers will be mainly focused on long-term gains, and that this will help them increase their market share in the country. At the same time, China Mobile is expected to see its share remaining in the 60 percent area during the next few years.

14 DAY TRIAL //

14 DAY TRIAL //