According to a group of scientists from the Oxford University, the human lifespan is not only increasing but this increase is accelerating. They believe that in relatively short time people will regularly live up to 120 years old. At the beginning of the 20th century, life expectancy at birth was around 45 years. Due to antibiotics and to various public health measures (such as the availability of clean drinking water) many infectious diseases are now avoided. Moreover, the infant mortality had decreased dramatically, even compared to what it was 50 years ago. The life expectancy at birth today is 75 years. But, as David A. Sinclair and Lenny Guarente write in Scientific American: "No doubt, future generations accustomed to living past 100 will also look back at our current approaches to improving health as primitive relics of a bygone era."

If living up to 120 years old seems a lot to you, you may be surprised to hear that some scientists seriously believe that this is a gross under estimation. One of them is Aubrey de Grey, a biomedical gerontologist from Cambridge University, who believes that "the first person to live to 1,000 has already been born". This is because he expects incredible advances in medicine, such as periodic repairs to the body using stem cells or gene therapy, are imminent. De Grey thinks that such treatments may even be able to stop the aging process entirely - he argues that if each repair lasts 30 or 40 years, science will advance enough by the next "service" date that death can be put off indefinitely.

What about critics of such "services" on ethical grounds? John Harris, Professor of Bioethics at the University of Manchester, answered them by saying that any society which applauded the saving of life had a duty to embrace regenerative medicine: "Life saving is just death postponing with a positive spin. If it is right and good to postpone death for a short time, it is hard to see now it would be less right and less good to postpone it for a long while."

Even if De Grey is over-optimistic, it is quite clear that the lifespan is going to increase significantly over the next decades. This rises several economical questions. Paul Hodge, director of the Harvard Generations Policy Program, has said that governments around the world have to face the pension crises, graying workforces and rising healthcare costs as soon as possible. The current policies are no longer valid.

"Life expectancy is going to grow significantly, and current policies are going to be proven totally inadequate," he said.

I'll discuss only one example - that of the pension system.

Why the current pension system has to be changed Shripad Tuljapurkar of Stanford University presented the following argument:

"There are 285 million people in the United States, with the median age around 36. Every two people over the age of 65 depend on money garnered from the wages of 10 working people age 20 to 65. If current trends continue, by 2050 the population will be 368 million, the median age will be 43, and there will be 6 people over 65 per 10 workers. Those are the conservative estimates based on data from the last 50 years, when life expectancy increased by one-fifth of a year per year in industrialized countries." (LiveScience.com)

What's the solution? Although Tuljapurkar description of the problem is definitely correct, his "solution" is not only over-simplistic, but also totally ridiculous and absurd:

"What you would need to do is have people retire somewhere between age 75 and 85," Tuljapurkar said. According to him, increasing the retirement age to 75 would still yield four retired persons per 10 workers. So, people will have to be forced to work until around 85. If we're not doing this economic collapse looms inevitable - we're told.

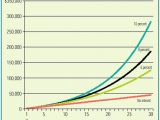

What's so ridiculous with this "solution"? Well, he has somehow forgotten that people usually have bank accounts and that there is something called compound interest. Take the following scenario: Suppose you start working around 20-25 years old. Each month, instead of spending all the money you earn, you save some small amount, placing it in a bank. The bank offers you interest. You are doing them a service, for allowing them to use your money, and they are paying you the interest rate in return - if you commit yourself that you won't get your money out for a longer period of time, say one year, they will give you a larger interest. And the point is, the next month, or year, you will get interest on interest, and so on. And if instead of a bank you choose an investment fund or the stock market, the interest rate can be much higher.

This grows exponentially. At first, it takes some time to start building up, for the first 10 or 15 years the interest the bank is paying you is virtually insignificant. But the bank deposit builds up faster and faster. It isn't very difficult to calculate that, by using this simple long-term strategy, one can easily be a millionaire at 60 years old or even earlier. And then, at whatever age one whishes, one could simply stop working and start living out of the monthly interest rate.

In other words, the entire pension system is redundant. Tuljapurkar argument, which is correct, only shows that the very idea that present workers should support present retirees is flawed. The present retirees have to be supported by their own past savings. This way, one isn't faced with the strange idea that the government should decide how much money the each retiree should get each month. One who saved more would simply have a bigger "pension".

Thus, what the government should do is not to rise the retirement age, but to create incentives for people to save money. One smart thing they could do for example is to stop printing money out of thin air to cover for their expenses and thus devaluing the currency.

The other side of the coin of the compound interest story is this: When one saves money, the bank doesn't just keep the money, it lends the money to investors, and investments are the very cause of economic progress. Thus, these enlightened "pensioners" wouldn't be people who simply consume part of the income of the present workers, in other words they wouldn't be the parasites the current pension system turns them into, they would be people that actually contribute quite significantly to economic progress.

Thus, the idea that people will be forced to work until 75 or 80 or 85 for "preventing economic collapse" is pure nonsense.

Longer lifespan will have the effect that a lot of people will have sufficient money in their second half of their lives to actually do whatever they want, to travel, to get together, to write books etc. etc. The longer lifespan social beneficial effects are so great that one cannot even make guesses about them.

14 DAY TRIAL //

14 DAY TRIAL //