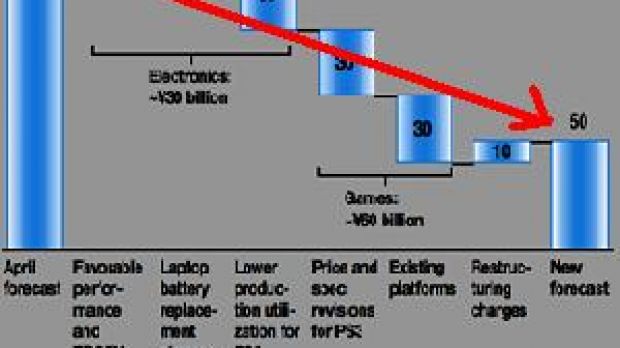

Sony unveiled a huge revision to its operating profits forecast for the full year as a result of the cost of replacing faulty batteries and unexpected setbacks in its games business, showed Financial Times (FT). Sony said operating profits would be 62 % below its previous forecast, at Y50 billion (?224 million) rather than Y130 billion, despite an unchanged revenue forecast of Y8,23 billion. Net profits are expected to be Y80 billion, 38% lower than its earlier estimate of Y130 billion. The projected profits fall comes as Sony struggles to turn round its electronics business - under the leadership of Ryoji Chubachi, chief operating officer - through a group-wide restructuring spearheaded by Sir Howard Stringer, chief executive.

The decline is largely drawn from recent problems with its lithium ion batteries and in its games division - the delay to launch the PlayStation 3, Sony's most important product launch in years, with a lower price for it and a reduction in initial shipments. The setback to the games division, positioned as a key driver of future growth, raises the question as to how long it will take Sony to see the results of its massive investment in the PS3, said the same publication.

Furthermore, Sony has been forced to delay the launch of the PS3 in Europe and reduce initial shipments when it is launched in the US and Japan on November 11 owing to difficulties manufacturing the blue laser diodes used for the Blu-ray Disc player incorporated in the games console. Additionally, it reduced the price of the lower end console in Japan in a move to compete more effectively with rivals Microsoft and Nintendo whose consoles are significantly cheaper.

Despite all this Sony gained Y54 billion from favorable exchange rates and higher contributions from key products, including digital cameras and flat panel LCD TVs.

14 DAY TRIAL //

14 DAY TRIAL //