Three physicists from University of Tokyo have studied price fluctuations in the months before and after a stock market crash occurs and have found that the statistical properties of these fluctuations differ considerably from the Gaussian nature of the usual fluctuations, that happen during normal times. This may offer a way to predict stock market crashes.

The team has studied the Standard & Poor's S&P 500 index, first determining the long-term average trends and then mapping the small deviations from the average trend (the fluctuations). The fluctuations in the stock market, like virtually all the fluctuations in the world, have a Gaussian, bell-shaped, probability distribution. This means that a large deviation, either up or down, from the average is much less likely than a small deviation. I.e. it is not likely that your stock price will suddenly go up or down very much, it is much more likely that it will vary by small amounts. What will happen to a particular stock price on the long-term depends on how successful the company is, but on the short term (such as days or maybe even weeks) there are random fluctuations that don't reveal anything.

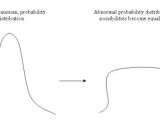

However, when researchers looked at 2-month periods surrounding major crashes such as the Black Monday event of October 19, 1987, they saw a different story: Fluctuations of all magnitudes were equally probable. The bell-shaped probability distribution was gone. It was like the stock market prepared itself for switching from one normal distribution to another, different, normal distribution and in the process it needed to make all the fluctuations equally probable.

This type of statistical phenomenon (called "criticality") is also known to physicists - it is for instance what happens during earthquakes or during phase transitions. For example, prior and after earthquakes large and small fluctuations in earth's vibrations become equally probable. Unfortunately, in case of earthquakes this happens at very short notice (just around 10-15 minutes before the actual earthquake) so this abnormal statistical behavior is not very useful for predicting earthquakes. But in case of stock markets this behavior manifests months in advance.

However, in case of stock market case researchers have found that the probabilities do not change with the size of the event, while in other cases such as earthquakes, the probabilities usually follow a so-called power law. In other words - one can predict a stock market crash but cannot predict its severity. This poses an unsettling problem: should one make such predictions? For instance it might be that the next stock market crash would only be minor, but if you predict it you may cause panic among investors and what would have otherwise been an only minor crash it would turn into a major one.

Zbigniew Struzik, one of the co-autors of the study, says it is unclear what individual trading decisions lead to criticality in the stock market, but he and the team at the University of Tokyo are working on finding explanations. In this context, it's worth noting that, according to von Mises-Hayek theory of the business cycle, such crashes are not caused by individual trading decisions at all, but by the Central Bank's action of printing fiat money (in US case, the Federal Reserve). A video documentary on the subject is available from the von Mises Institute site (Money, Banking and the Federal Reserve). In other words, according to this theory, one can predict the magnitude of the incoming crash by monitoring the inflation in past years - if inflation was small, the crash would probably also be small. In fact, historically Ludwig von Mises predicted the Great American Depression this way.

14 DAY TRIAL //

14 DAY TRIAL //