We reported a few days ago that Palm announced plans to remarket around 18.5 million common shares, and that the company was planning to use the funds it would cash from the deal for the launch of its upcoming Palm Pre handset, as well as for the future development of devices. In addition to this, the company also stated that Elevation Partners, which paid $49 million for the shares in question back in January 2009, would be able to recoup its money.

Palm has made another announcement now, saying that it has raised the size of the common share stock it plans to remarket to around 23.125 million, and that it expects to be able to receive net proceeds of approximately $83.9 million from the deal. At the same time, the company also states that Elevation Partners will use the recouped funds to buy about 8.2 million shares of phone maker's common stock.

According to Palm, the public offering price per share will be $6.00. In addition, the company also says that underwriters will "have a 30-day option to purchase approximately 3.5 million additional shares of common stock from Palm to cover over-allotments, if any."

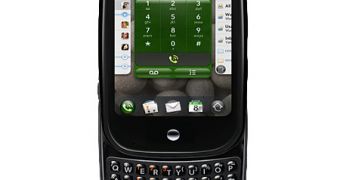

As many of you might already know, Palm Pre is one of the most anticipated mobile phones to be launched this year. Even so, while most of the market watchers believe that the device will prove a real success, Palm warned recently about the risks that the launch of Pre would involve. According to the phone maker, given the fact that the company has seen a depreciation of its sales lately, both the importance of Pre and the risks that an unsuccessful launch could bring have risen.

For what it's worth, we shouldn't have to wait too long to see Pre launched on Sprint's airwaves, as this is the carrier that will have the device exclusively until the end of the ongoing year. And perhaps iPhone will finally have a strong competitor to lose some market share to.

14 DAY TRIAL //

14 DAY TRIAL //