The long-time traditional adept of a strategy focused on building and then maintaining and protecting a high level of momentum for its monopolies, Microsoft has cut the construction aspect of the process when it went against Google with the $44.6 billion acquisition proposal of Yahoo. With monopoly and antitrust accusation flying from Redmond to Mountain View and the other way around, as Yahoo is cut dead in the middle, the fights are over the online search and online advertising markets. But Google understands that it's about much more than search share with Microsoft.

Sure enough, $44.6 billion will buy Microsoft the Yahoo brand, its server farms and all the eyeballs on the Yahoo web properties, which by even the safest estimates is well over half a billion worldwide per month. In all fairness, Microsoft said that it's about search and advertising. The fact that it will have to deal with immense tactical and logistical issues when integrating Yahoo's product, service and customers with its own, facing serious overlapping issues is not at the top of the table for Microsoft's priorities.

In its race to become the runner-up on the online search and advertising markets behind Google, the Redmond company is ready to cough up almost $45 billion for some extra search share, for more audience, and for extended reach. Building has done nothing for Microsoft so far, as the company's Online Services Business turned up a revenue of just 863 million in the second financial quarter of 2008. Yahoo is not in a better place, with profits falling, audience eroding and a shaky search engine market share on a descendant trajectory.

Still, despite its current monopoly of the online paid search market of 75% worldwide, and a search share between 65% and 85% on localized markets, Google essentially remains a two-trick pony. The Mountain View search giant is indeed expanding in the cloud with various Software as a Service offerings that mimic desktop products, but nothing comprehensive enough to completely focus users online. And nothing still for a long time to come. In the meantime, Microsoft is working not only to substantially increase its search share and online advertising business with the addition of Yahoo, but also to shift the focus away from search ads.

"While search has been the main driver of the blistering growth of online advertising in the past, at least partially because of the 'last ad clicked' performance measurement standard (pioneered by Atlas in the late 90s), we do not believe this will necessarily be the case in the coming years. The current system for tracking ad conversions, while the best available for years, is not optimal because it gives all credit to that last ad seen or clicked - often a search engine - and not any credit to other ad units the consumer may have seen prior that helped influence the user to seek more information about the advertiser. Thus, Search has gotten more than its share of the credit, but that's starting to change. We'll be making significant inroads here in 2008 through our continuing ground-breaking work in the area of 'conversion attribution,' a new Atlas technology offering that will do a better job of 'giving credit where credit is due," explained Brian McAndrews, senior vice president of the new Advertiser and Publisher Solutions Group, at Microsoft, as cited by Seattle Times.

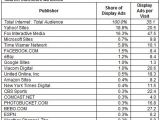

Outside text or paid search ad impressions, Google is nothing. The Mountain View company's business in terms of display ads will grow with the addition of Double Click, but so will Microsoft's with the addition of Yahoo. And Yahoo is at the top of the U.S. Internet properties based on number of display ads delivered, according to comScore.

"Yahoo! Sites ranked as the top display ad publisher property in November, with 18.8 percent of display ad views, followed by Fox Interactive (16.3 percent), Microsoft Sites (6.7 percent), Time Warner Network (5.8 percent) and Facebook.com (1.5 percent). Nearly half (49.1 percent) of all display ads seen by U.S. Internet users originate on only five properties, illustrating the concentration of advertising among a few properties," comScore stated.

Google websites account for a share of only 1% of the online display ads. Microsoft together with Yahoo would have over 25%. With Yahoo, Microsoft would gain the top world platform for serving rich media, static images, or display ads. "Since just a handful of publisher properties deliver a preponderance of display ads, when one goes beyond the top properties it's clear how fragmented the online advertising market is, underscoring the importance of advertising networks in aggregating the long tail," explained Alistair Sutcliffe, vice president of comScore Advertising Solutions.

14 DAY TRIAL //

14 DAY TRIAL //