While most psychiatrists will tell you that you need to build up your self-confidence to reasonable levels in order to succeed in life, only a few draw your attention to the side-effect of this behavior, namely overconfidence. For a long time, experts in human behavior have been amazed at how this way of acting, which has led to wars and the collapse of banks, has evolved in our species. By all accounts and purposes, it shouldn't have. If something is detrimental to a species, then natural selection usually weeds that something out. Now, finally, scientists have an answer, Technology Review reports.

Over the years, the most severe acts of destruction (the two world wars, the Cold War, the Vietnam War), the collapse of the financial system (twice), as well as the lack of preparation in front of natural disasters (such as the 2004 Asian tsunami and Hurricane Katrina) have been all blamed on human overconfidence. University of Edinburgh expert Dominic Johnson, and University of California in San Diego (UCSD) colleague James Fowler say that all these events have this human trait in common.

But, if so, psychologists are more in the dark than ever. How come this behavior endures, when it's clear that it's not at all beneficial to humankind, and that it leads to the destruction of communities? Also, overconfidence is ubiquitous, as in all people have it. For instance, most people put themselves above the average risk, and say that they are better than, for instance, regular drivers. However, that is a statistical impossibility, as most drivers cannot be above the average. Most drivers are the average. Only a few are above or below it.

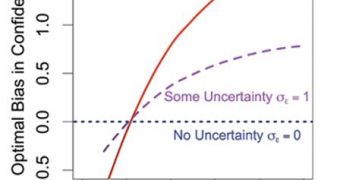

Johnson and Fowler believe that they have the answer to this seemingly impossible riddle. They have developed a mathematical model that clearly shows how, in many cases, being overconfident yields most benefits. The results were drawn from experiments in which overconfident individuals competed against ordinary individuals. Additionally, by applying principles from game theory, the experts identified that, if the reward of playing a game was at least two times larger than the costs, then indeed overconfidence was the best strategy, and the most likely to lead an individual to success.

14 DAY TRIAL //

14 DAY TRIAL //