Google reported on its first quarter financial results. While some were expecting a tour de force from new CEO Larry Page, that wasn't the case, he only gave a brief introduction.

Instead, Google showed a healthy revenue growth and a big increase in spending leading to smaller earnings, which investors didn't really like, sending Google stock down in after-hours trading.

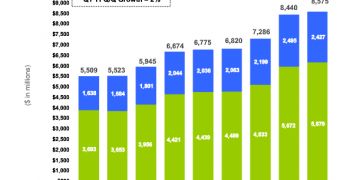

The company brought in $8.58 billion in the first quarter of 2011, a 27 percent increase from the same period last year and a slight 2 percent improvement over the previous quarter, which had been Google's strongest yet.

"Non-GAAP operating income in the first quarter of 2011 was $3.23 billion, or 38% of revenues. This compares to non-GAAP operating income of $2.78 billion, or 41% of revenues, in the first quarter of 2010," Google announced.

"GAAP EPS in the first quarter of 2011 was $7.04 on 326 million diluted shares outstanding, compared to $6.06 in the first quarter of 2010 on 323 million diluted shares outstanding. Non-GAAP EPS in the first quarter of 2011 was $8.08, compared to $6.76 in the first quarter of 2010," it continued.

It's the earnings per share that sent investors scurrying away since they were below the analyst estimates of $8.11 EPS. The lower than expected income was mostly due to increasing costs, with employees, marketing and research.

Google rewarded all of its employees with a 10 percent pay increase in the first quarter. It's also spending more keeping high level execs sticking around. Google paid $432 million in stock-based compensation in Q1 2011 up from $291 million in Q1 2010.

Google hired 1,916 in the first three months of the year, going from 24,400 full-time employees at the end of the year to 26,316 at the end of Q1. Google promised to increase headcount by at least 6,000 people by the end of the year and is already well underway towards achieving that.

14 DAY TRIAL //

14 DAY TRIAL //