Apple brags about Apple Pay on every single occasion, and while no official adoption figures are available, it’s believed the global pandemic has completely changed the way people pay for goods, with more and more users switching to digital wallets.

Well, a report from PYMNTS indicates this didn’t actually happen in the United States, as while contactless and cashless payments have declined substantially last year, most people just decided to stick with a credit card and not use a digital wallet like Google Pay or Apple Pay.

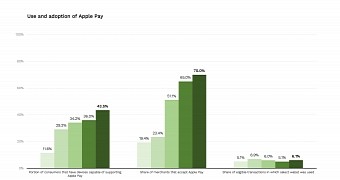

Furthermore, the survey, which included 3,671 U.S. consumers, reveals that only 6 percent of the Apple users actually rely on Apple Pay for payments in stores across the country.

“Seven years post-launch, new PYMNTS data shows that 93.9% of consumers with Apple Pay activated on their iPhones do not use it in-store to pay for purchases,” the survey reveals.

More people using a credit card

For some reason, users across the world found it more convenient to pay with a credit card rather than use a digital wallet last year, perhaps because many decided to leave their phones at home and therefore avoid the whole disinfection nightmare that everybody had to do.

“We asked people what payment methods they used to pay in the last 24 hours when shopping in a store and compared it to the same data captured in prior studies. We observe that between 2019 and 2021 cash use declined 20.1%; credit card use increased by 33.8%; and debit card use declined slightly by 7.2%. Mobile wallet use in-store declined 26.2%,” PYMNTS explains.

The good news for Apple is that while the Apple Pay adoption is still small, at least it’s not declining. The study shows the use of all the other digital wallets out there completely collapsed.

14 DAY TRIAL //

14 DAY TRIAL //