Another bleak quarter for Yahoo, which has revealed its financial report for the Q2 2011. Revenue is slightly down from the previous year and, while net income was on par with expectations, the rest of the numbers were below estimates.

Yahoo blames the underperforming search agreement with Microsoft for the slump in revenue, but there's another, bigger threat and cause, dwindling display ad revenues in Q2.

The company is largely dependent on display ad revenue from big advertisers and this has been Yahoo's strong point so far, even as Google is slowly driving up display ad revenue as well.

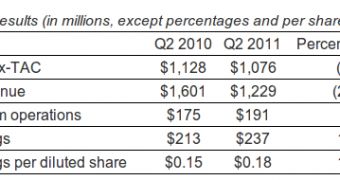

"Revenue excluding traffic acquisition costs was $1,076 million for the second quarter of 2011, a 5 percent decrease from the second quarter of 2010, primarily due to the revenue share related to the Search Agreement with Microsoft," Yahoo said in a statement.

One less bleak spot for the quarter was net income which was $237 million, an 11 percent rise from the same quarter last year, this on smaller revenues.

Earnings per share were also up 18 percent, coming in at $0.18, on par with what analysts were expecting.

"For the quarter, earnings per share was up by 18% year over year. We made clear progress in search, and saw strong growth in engagement on our media properties," Carol Bartz, CEO of Yahoo, said.

"We experienced softness in display revenue in the second half of the quarter due to comprehensive changes we have made in our sales organization to position ourselves for more rapid display growth in the future," she explained.

While the report shows yet another disappointing quarter for Yahoo, the company actually fared better than in the previous quarter. Still, investors are not happy and stock price is down, despite already being at a very low point.

Yahoo needs to do something, and fast, but it doesn't seem that the current team is managing to turn the tides. People have been asking for Carol Bartz's head for a while now and the latest quarter is providing them with more ammo.

14 DAY TRIAL //

14 DAY TRIAL //