Thwarting Microsoft's hostile bid to take over his company has become Jerry Yang's mission, as his actions in the past two months show. After running from possible alternative to viable mergers and back, the Yahoo! CEO was faced with a new wave of threats, turning up the knob for pressure on his shoulders. Don't understand that he is fighting by himself, Yang still has some trusted friends on the board, and they currently outnumber the ones for accepting the bid, but he is the most public figure of the lot and is in the position to make a difference.

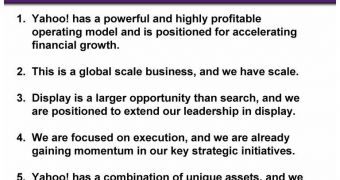

In a presentation that was filed with the SEC, Yahoo! just doesn't cross fingers and hopes to have something poke it in its eye if the revenues don't grow up to $8.8 billion, or 72 percent, by 2010. It's the cry for help from the shareholders to not consider Microsoft CEO Steve Ballmer's bid. You can see the summary of the 35 pages worth of arguing on the left.

Out of them, there are a few that can be doubted. The first, "Display is a larger opportunity than search, and we are positioned to extend our leadership in display," has serious arguments against. I'll just name one, the biggest: Google's approved acquisition of DoubleClick. The combination will boom in the display market for two reasons: both of the companies have been known to be very good and very successful in what each does, and second, the Google name that is now behind it all weighs heavier than Yahoo! in trust being placed in it by people allover the world.

The second one, placed at number 4, reads that: "We are focused on execution, and we are already gaining momentum in our key strategic initiatives." Such initiatives, at the time, have been social networking, with Yahoo! 360 turning to be one of the biggest busts, video, where the moment competition rose, Yahoo! started dropping percentages like it had leprosy. Then again, opening search might turn everything around, but it will take time, and that is the resource shareholders have a limited amount of.

14 DAY TRIAL //

14 DAY TRIAL //