Those in the stock exchange business are highly aware that when it comes to trading every millisecond counts. Experts have long argued that the flaws present in trading systems today can be leveraged to manipulate prices and basically perform fraudulent operations, but a recent incident demonstrated these vulnerabilities.

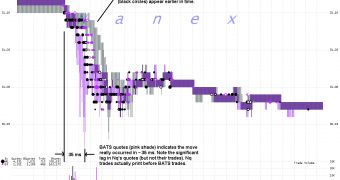

“On March 20, 2012 at 13:22:33, the quote rate in the ETF symbol SLV sustained a rate exceeding 75,000/sec (75/ms) for 25 milliseconds. Nasdaq quotes lagged other exchanges by about 50 milliseconds. Nasdaq quotes even lagged their own trades -- a condition we have jokingly referred to as fantaseconds,” Nanex reported.

So what does this actually mean? In simple words, it means that some traders flooded the system which, due to the security holes that exist, caused silver prices to drop considerably.

High frequency traders took advantage of the flaws and exploited the NASDAQ silver ETF, Alexander Higgins explains.

The fantaseconds Nanex refers to is a term that defines a unit of time measurement which was unveiled back in September 2011 when a “time warp” was recorded in the trading of Yahoo! stock.

At the time, exchange timestamps revealed that the Yahoo! trades were executed on quotes that came into existence only 190 milliseconds later.

By taking advantage of this flaw traders can execute quotes before they even exist in the system.

Zero Hedge believes that someone wanted the price of silver to drop at precisely 13:22:33, on March 20, so they “bent the laws of relativity” and executed quotes in the future. It’s not an easy thing to get your head wrapped around if you’re not in the business, but the incident clearly demonstrates that flaws in the market exchange system can be leveraged to manipulate prices.

The 50 millisecond lag recorded by NASDAQ may not seem much for the average Joe, but for a profit driven crook it can worth gold.

Note. My Twitter account has been erroneously suspended. While this is sorted out, you can contact me via my author profile.

14 DAY TRIAL //

14 DAY TRIAL //