Laptops and desktop shipments have been going down the hill in 2013, with tablets cannibalizing most sales.

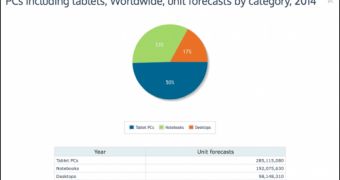

New information provided by research firm Canalys suggests that the trend will be extended onto 2014, as well. According to them, tablet business will continue growing until the point where slates will account for 50% of all PC business worldwide.

Driving the surge will be combined force of Android tablets which will manage to account to up to 65% of all shipments. Apple shall remain the biggest stand-alone tablet brand, with 30% hold of the overall market.

Canalys analyst Pin Chen Tang explained that 50% of tablet share translate into the 285 million slates being sold throughout next year. By 2017 numbers will reach the 396 million units threshold.

Apple and Samsung will still be the main players of the 2014 tablet fighting arena, but you might be wondering where Microsoft stands with all of this. Canalys forecasts that the PC king will manage to grab just 5% of tablet market share in 2014, a lot having to do with Redmond acquiring Nokia.

5% might not seem like much, when compared to Android or Apple numbers, but consider the fact that in 2012 Microsoft only had a hold of 2%. Will be company be able to remain in the tablet game, at this pace? We have already heard of companies like BlackBerry and HTC and how they are considering abandoning the tablet game altogether.

As for other brand vendors like Acer, ASUS, HP and Lenovo, they have all started offering entry-level products for super affordable prices (some even below $150 / €111) in an attempt to remain important players on the market. Even so, Canalys believes the companies will have a hard time competing against local vendors. 2014 will be a merciless year indeed.

“Expect 2014 to bring a flurry of acquisitions, mergers, and failures as PC hardware vendors of all sizes struggle to maintain their desktop and notebook business while attempting to capitalize on a tablet market that will see great volumes driving limited value.”

14 DAY TRIAL //

14 DAY TRIAL //