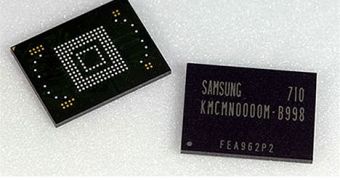

SanDisk Corp and Micron Technology received an unexpected boost of their combined market share of flash memory chips after the main NAND memory chips producer Samsung Electronics had to stop some of its production of flash memory chips after the facility near Seoul was hit by a power outage, according to InformationWeek.

Because Samsung Electronics is the most important memory producer, having the largest market share on both DRAM and NAND segments, the interruption that occurred may affect the entire memory industry. Samsung's rivals for the memory market will of course benefit, and most of all, the bigger producers like Toshiba and Hynix Semiconductor, alongside with SanDisk and Micron are at an advantage. Because there is an ever increasing demand of NAND flash chip memories on the market, the remaining producers will see more supply commands coming their way. Even if the power outage from the Samsung production plant was repaired immediately, most of the memory chips that were in the production queue will have to be discarded. "It is probable that at least half of the chips already in the fabrication process will have to be discarded," said Lee Min-hee, an analyst for Dongbu Securities. "Taking into account another two weeks for ramp-up of the lines after cleanup, Samsung could very well lose a month's worth of chip shipment".

The ripple effects from Samsung's troubles with its Korean NAND producing facilities were felt almost instantly as the competing companies found themselves rising. Companies like Qimonda, that is a big memory chips manufacturer, are almost unaffected by the ripple effect, as its stock increased only slightly. Smaller companies (both producing and vending ones) on the other hand are rising or falling rapidly.

Of course, the most affected by Samsung's problems will be the end customers, because this is the time frame when most consumer electronics manufacturing companies are stocking up parts for the incoming holiday and gift giving seasons. Even if Samsung has no less than 11 production lines that are dedicated to NAND memory chips, because some of them are older and have a lower capacity, it is most likely that the shipments in the third quarter will be 15 percent lower. On the share market, while Samsung registered a slight loss, Micron, another NAND memory manufacturer, saw its rating go 3.6 percent higher, according to Extreme Tech news site.

14 DAY TRIAL //

14 DAY TRIAL //