Pandora, a company that's seen plenty of ups and downs in the decade since launch, is now filing for an IPO hoping to raise $100 million. The online radio has seen big growth in the past year, both in terms of users but also in revenue. Still, it's not quite profitable and doesn't expect to be this or the next year either.

The company filed a document with the US Securities and Exchange Commission announcing its intentions.

"Pandora today announced that it has filed a registration statement on Form S-1 with the U.S. Securities and Exchange Commission relating to a proposed initial public offering of shares of its common stock," Pandora said.

There are some financial details missing from the document, the company hasn't priced the shares yet. Some rough estimates put the company's worth at around $1 billion.

Pandora provided quite a lot of numbers for prospective investors. The service has over 80 million registered users at this point. 34 million of those came in the last year alone. It started 2009 with just 22 million registered users.

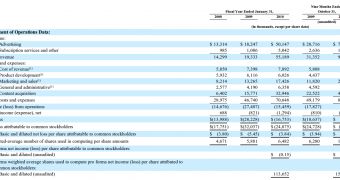

Financially, things are looking up as well. Revenue in the first nine months of 2010 was $90 million, a big improvement over the same period in the previous year when it managed to bring in only $31 million, this while losing $18.6 million. It only lost $328,000 in 2010.

In its lifespan it has amassed a deficit of about $84 million. But the focus has been on growth, which the numbers definitely show. However, the company cautions that it may not be able to turn or sustain a profit any time soon.

The current climate seems ripe for IPOs, which many internet companies have postponed for as long as possible. With the recession and the general sentiment towards tech companies going public, many have put off the move. But things are beginning to change, one of the latest big examples is LinkedIn which announced the move a couple of weeks ago.

14 DAY TRIAL //

14 DAY TRIAL //