LS9, Inc. announced today that it has received its last round of funding of $30 million, which allows the company to speed up the commercial production of their renewable chemicals and fuels.

This is a private industrial biotechnology company that uses synthetic biology in an attempt to develop renewable industrial chemicals and proprietary biofuels compatible with the existing fuel distribution and consumer infrastructure.

The company was awarded the US Environmental Protection agency's highest environmental honor for its innovative Renewable Petroleum(TM) technology, in June 2010.

The investment round was led by BlackRock, a prestigious company with over $3 trillion in assets under management.

Noubar Afeyan, Chairman of the LS9 Board of Directors and Managing Partner of Flagship Ventures, said that they “are very proud to welcome a firm with the size, track record and global reach of BlackRock as a new investor in LS9.

“This funding round is a strong endorsement of the quality of LS9's technology, team, and ability to execute.”

Flagship Ventures, Khosla Ventures, Lightspeed Venture Partners and CTTV Investments LLC, the venture capital arm of Chevron Technology Ventures LLC are all previous investors in the project, also participating in the round.

These last $30 million will be used to prepare the company's lead products for commercial production and support all additional development and growth programs.

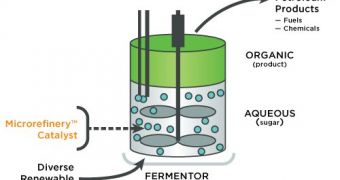

This technology is revolutionary because it uses a one-step fermentation process to convert renewable plant-based materials into several types of fuel and chemical products.

For two years now, the firm has been successfully operating its pilot plant in South San Francisco, California and in January 2010, it announced the acquisition of a larger-scale production facility in Okeechobee, Florida.

Ed Dineen newly appointed, President & Chief Executive Officer of LS9, added that they “are very pleased that this outstanding group of new and existing investors has demonstrated their commitment to LS9's mission to bring renewable chemical and fuel products to market.

“In particular with BlackRock the world's largest asset manager joining our investor group, and given their increasing focus on renewables, we believe this will benefit LS9 in a number of ways.

“With this new round of funding, LS9 will be able to accelerate implementation of our plans to commercialize our technology and grow our product portfolio.”

14 DAY TRIAL //

14 DAY TRIAL //