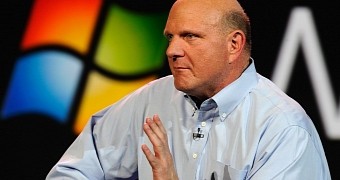

Steve Ballmer is no longer Microsoft's Chief Executive Officer, but that doesn't necessarily mean that he cannot be called to court for some of the tax practices the Redmond-based software giant turned to while he was holding the top spot at the company.

The United States Internal Revenue Service filed a legal complaint against former CEO Steve Ballmer and nine other Microsoft executives, including former Chief Strategy Officer Craig Mundie, former executive and retired Bill & Melinda Gates Foundation head Jeff Raikes, and former Windows and Server Development Chief Jim Allchin, to have them testify in a case regarding Redmond's practices of tax dodging using foreign subsidiaries.

The Seattle Times writes that Microsoft executives need to provide information on transfers that were made to subsidiaries in Puerto Rico and Bermuda, which generated billions of dollars of impact on the taxable income between 2004 and 2006.

Microsoft doesn't allow executives to testify without an agreement

The same report reveals that Microsoft has already discussed with the IRS the possibility of having the aforementioned executives testify, but the company has actually refused the inquiry without an agreement on the terms of the interviews.

The company thus wants to avoid any potential problems that could be caused by its former executives being quizzed by the IRS, so it's actually seeking an agreement that would thus protect its case.

“As a global business, Microsoft adheres carefully to the laws and regulations of every country in which we operate,” a company spokesperson was quoted as saying.

At the same time, Redmond says that it has already provided by the IRS with no less than 1.2 million pages of documents, and agents have discussed with more than 50 company employees on the case.

This isn't the first time that Microsoft is accused of tax dodging using overseas subsidiaries, but the company has always denied all claims, pointing out that it not only pays all taxes in the United States, but also has a major contribution in terms of employment because it had several thousands of workers in the United States alone.

We've also contacted Microsoft for more details on the IRS investigation and will update this story when we receive an answer.

14 DAY TRIAL //

14 DAY TRIAL //