Google can be used to predict stock market trends, a new study shows, simply from using data publicly available via the company’s trends.

Google Trends, as many probably know by now, tracks terms that people use in the search engine to indicate what the most popular queries are. This data can be used to forecast changes in stock prices, say researchers from the Boston University and the University of Warwick in the UK.

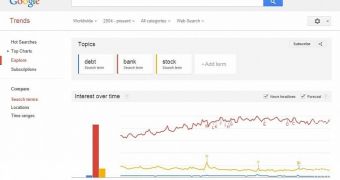

For a new study, they grouped the most popular keywords used in Google’s search engine into several topics and used Trends to compare their search volume between 2004 and 2012 and the fluctuations in the S&P 500 index, the market index for the 500 largest companies based in the United States.

The study shows that Google searches on business and political topics surge before a fall in the stock market, while searches for music, entertainment and other “light” topics weren’t found to have any important connection to changes in the stock market.

In a previous effort, the researchers tried to look at various finance-related terms such as “debt” or “bank,” in an attempt to figure out if searches for these can be correlated to fluctuations in the stock market. The results were positive – an increase in the volume of this type of searches can indeed be used to predict a fall in stock prices.

“Increases in searches relating to both politics and business could be a sign of concern about the state of the economy, which may lead to decreased confidence in the value of stocks, resulting in transactions at lower prices,” said Suzie Moat, one of the co-authors of the study, who works as an assistant professor of behavioral science at Warwick Business School, Live Science reports.

According to the authors, the data gathered from Google helps to provide an unprecedented insight into information large numbers of people are gathering, and the study brings evidence that such data can be used to create forecasts of actions people eventually take in their lives.

It’s not just the financial markets that Google’s data can be useful for, but also other domains such as natural disasters, protests, elections and disease epidemics.

However, as far as the financial market goes, it is rather funny that Eric Schmidt, former Google CEO and current chairman of the company, admitted at one point that they once had a conversation within the company where they figured they could just try and predict the stock market. “And then we decided it was illegal. So we stopped doing that,” he said on the topic.

14 DAY TRIAL //

14 DAY TRIAL //