Google has revealed its financial details for the fourth quarter of 2011. All important metrics were on the rise, quite significantly from the previous year, as expected, but the absolute numbers managed to fall below market expectations, leading to Google stock getting a beating.

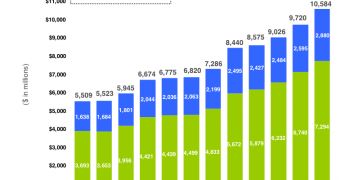

Revenue was $10.58 billion, €8.21 billion for the quarter, 25 percent more than in the same period in 2010. It was also the first quarter in the company's history when revenue grew over the $10 billion mark.

Net income was $2.71 billion, €2.10 billion up from $2.54 billion, €1.97 billion in Q4 2010. Non-GAAP income was $3.13 billion, €2.43 billion, up from $2.85 billion, €2.21 billion in Q4 2010.

69 percent of revenues came from Google's own site. They also grew 29 percent compared to the same quarter in the previous year.

Google's partner sites were responsible for 27 percent of revenue, a 15 percent increase in revenue over the previous year.

53 percent of total revenue came from outside of the US, from 55 percent in Q3 2011 and 52 percent in Q4 2010. The UK was once again Google's biggest market outside of the US, generating $1.06 billion in revenue, €822 million or £686 million, 10 percent of the total.

One of the things that's got investors spooked is the drop in cost-per-click, the amount of money Google makes every time someone clicks on an ad. It dropped eight percent compared to Q4 2010 and, more importantly, it also dropped eight percent compared to the previous quarter.

Google continued to add to its coffers, it is now sitting on $44.6 billion, €34.61 billion in cash and cash equivalents, up from $42.6 billion, €33.06 billion in the previous quarter.

Google argued that investors shouldn't be worried about the small hiccup and instead focus on the rising revenue. But Google has got one rough year ahead of it, especially if the Motorola acquisition is approved.

14 DAY TRIAL //

14 DAY TRIAL //