How do you react if you receive an email from a company that claims you can make easy money by purchasing and selling Facebook shares? Whatever your answer may be now, we’ll make sure to give you the right one by the end of this article.

Security experts from Symantec have come across a new scam email that leverages Facebook’s Initial Public Offering (IPO).

Bearing the subject “Facebook (IPO) Subscription Partnership Proposal,” the offer is apparently made by the managing director of a UK finance firm with headquarters in London, “Hongkong” and Dubai.

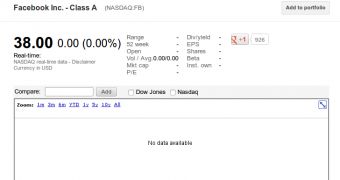

The recipient is lured with promises of easy money that can allegedly be earned by purchasing Facebook shares at $38 (29 EUR) and selling them back to the company for $40 (30.4 EUR).

“The beauty of this investment strategy is that you are not investing your own money but would be making about US$2.00 net profit on top of any amount of shares you purchased,” reads part of the phony email.

“For-example, if you buy 10 units of FACEBOOK shares at US$38.00 per share and you resale back to us at US$40.00, you should be making US$20.00 profit without stress. And, if you do have your own money to invest, we would encourage you to buy and we would add up US$2 on its purchase value and buy them all no matter how many shares you acquired.”

So let’s take a close look at the hints that reveal this offer’s “crookedness.”

First of all, it comes from an email address that's not hosted on the company's official website. Don’t be impressed by an email address that looks like [email protected].

Furthermore, what company on this planet would simply hand you over $2 (1.5 EUR) for no good reason? And believe us when we tell you, as sophisticated as it sounds, there is no reason why someone would buy shares from you for a high price “just because.”

Users who reply to the email and “purchase” the shares are actually handing over the money to the fraudsters. Remember! If it sounds too good to be true, it usually is.

14 DAY TRIAL //

14 DAY TRIAL //