Digital imaging evolves constantly; being up to date can become a quite challenge for passionate professionals in this area, as well as for manufacturers, who try their best to be one step ahead of consumers' wishes, or even to induce them sometimes.

Jurassic click

Though Kodak had owned the digital sensor manufacturing technology ever since 1986, the first digital camera for consumers, Apple Quicktake, was launched as late as 1994; the size of the device made almost impossible any attempt to manipulate it or to take pictures.

The camera was able to take 10 snapshots at most, after which the camera needed to be connected to a PC for downloading them; external storage capabilities were still in the process of design. Actually there was no mobility involved, and since PC connections were mostly serial, downloading pictures took just a bit less than? forever.

In less than a decade, digital camera technologies became capable of introducing an impressive list of innovations; several present trends are still to be perfected: huge resolutions and higher sensitivity, higher flexibility and processing power, lower costs per image, and a pricing more and more convenient.

Digital attack

For the first time ever, the digital camera sales in 2003 outnumbered classical cameras; the digital imaging market seems to keep on recording the same explosive growth rates while additional facilities are being added: higher and higher maneuverability and ease at use for lower pricings. Digital camera manufacturers began inventing new equipment, software and technical support facilities in order to attract stable clients.

The digital imaging was boosted in the mainstream and keeps on developing, copying some of the facilities in the traditional camera market with regard to the user segmenting and acquisition behavioral types. The rapid boost of digital camera is due to several factors, such as much friendlier user interfaces as compared to traditional cameras, aggressive marketing policies initiated by manufacturers and resellers and the full satisfaction of the clients' needs.

According to the end-2004 PMA U.S. report, digital camera sales boosted by 30% as compared to 2004, reaching $25.1 million, standing for 67% of all cameras sold. The digital camera penetration rate reached 40% in the United States, as compared to the 30% noted back in 2003.

The boost is far from being over, as estimates forecast a peak to be noted in December 2006, when the US penetration rate is expected to be around 63%.

During 2005, the digital camera sales growth rate is expected to be 13%; Photo Marketing Association International estimates that by the end of this year, at least one digital camera will be available in 52% of the American homes.

The situation in the United States reflects the worldwide situation, as InfoTrend Research Group estimates that the number of digital cameras to be sold during 2004 will reach 53 million worldwide; the annual growth rate is an estimate 15% for the next four years, which means that more than 82 million pieces will be available worldwide in 2008. The next two regions (besides the United States) where digital camera market penetration contributes to boosting the already impressive statistics are Japan and Europe; regions like Asia, China and others currently share a mere 10%, but are getting ready to recover in this imaging race. During 2008 these regions are expected to cover 27% of digital camera sales, as more and more people tend to give up classical cameras. As far as the manufacturers are concerned, the battle for the first five was won by Canon, Sony, Olympus, Fuji and Kodak, jointly holding 75% of the worldwide market in 2004.

In spite of such impressive numbers, digital camera domination seems to be threatened by the apparition of mobile phones integrating cameras.

As long as mobile phone cameras were low-performance (featuring 1, maybe 2 megapixel sensors at best), such trend raised no concerns. Lately, camera capabilities became an integrated standard feature in mobile phones and, more concerning, mobile phone cameras get closer and closer to the performances of digital cameras.

The mobile phones integrating 3- or 4-megapixel cameras are no longer news, and the design of new storage cards and options for mobile phones solved the low-storage problem, which was one of the main issues pleading for digital cameras.

This trend may however be deemed as beneficial to users. It is very likely that the low-entry digital cameras will be replaced by mobile phones integrating camera capabilities; however, the future of digital cameras depends on different performances.

Low-cost Megapixels

During the past two years, the fall of digital camera pricing became noticeable. Almost all major manufacturers have new models for low prices, or cheaper versions of already-launched cameras.

The decrease noted in the prices for which manufacturers purchase components like sensors and memories will lead to ever lowering pricings. The average price paid by manufacturers for building a digital cam was USD 274 in 2003, as compared to USD 301 in 2002; the average price paid in 2004 is somewhere around the same amount.

The 4-megapixel cameras began to be regarded as entry-level, and started replacing 2- and 3-megapixel cameras. The average pricing for a 4-megapixel cam is expected to go as low as USD 300, maybe less.

The 6-megapixel camera pricing ranges USD 400 to 700, but there are already several companies providing cams for less than USD 400. For the 5-megapixel cams the pricing range is USD 300 - 600.

This race for providing higher performance at lower costs reflects the manufacturers' hope to stimulate those willing to get a new, second camera or willing to replace an older, existing one.

What other capabilities do manufacturers suggest, besides more megapixels?

Design, display, connectivity...

First of all, the changes suggested by manufacturers imply a better design, as users need smaller, lighter cameras. Casio Exilim EX S100 is a 3-megapixel webcam, sized only 88 x 57 x 16.7 mm; it now looks like more cameras are planned to undergo such weight-loss diet. The real challenge for manufacturers consists of providing accessible, large enough menu buttons to ever smaller cameras, ensuring ease at use and high maneuverability.

But while cameras get smaller and lighter, LCD-s are expected to get bigger. The 2-inch display, standard capability in most of the existing models, now seems to be outdated, as manufacturers currently integrate 2.5 or even 3 inch displays, much closer to the sizes of digital video camera displays.

Performances and designs are not the only areas striving for more flexibility. Sending digital camera images directly to the printer is another capability making room for more innovations.

Instead of cables and docks, digital cameras get ready to integrate wireless connectivity. For instance Kodak EasyShare-One, a 4-megapixel camera to be launched in June and pricing around USD 599, allows wireless transfer of images via e-mail. The connectivity feature requires a Wi-Fi card, sold separately (USD 99).

The PictBridge technology, enabling cameras to directly connect to printers and docks is to be replaced by Imagelink, a new standard jointly promoted by Kodak, Konica Minolta, Nikon, Olympus, Pentax, Ricoh and Sanyo. The Imagelink-compatible cameras feature a standard connector which enables linking to any printer supporting this technology, regardless of its manufacturer. Theory sounds great, yet Canon, HP and Sony did not adopt this standard so far.

Hybrid mania - is mobile phone-integrated camera a real threat?

One thing is for sure: digital cameras are no longer designed just for photos. Today's cams can play MP3-s, send e-mails, voice-record, store other data, can capture and play audio and video streams from the Internet. Shortly, they can do almost anything. But besides digital cameras, which may have a variety of functions, some other devices can now take snapshots. You can now make pictures using your mobile phone, your MP3 player, your PDA, and probably in the near future you will also be able to use refrigerators and cars for this purpose.

Besides jokes, the mobile phones are a serious threat to digital cameras, since their pricing falls while their quality boosts. The number of mobile phones integrating digital cameras sold in the USA only reached 21 million pieces.

During 2004, 150 million such phones were sold, that is almost a quarter of all mobile phones sold. Picture quality is still poor, but mobile phone manufacturers recently began integrating 2-, 4- and even 7-megapixel cameras. Considering a 55% annual growth rate over 656 million phones will be available on the market in 2008, ready to take any pictures anywhere and anyhow.

There are still some issues to be solved, like the lack of inter-compatibility between phone manufacturers or between the companies providing mobile telephony services, making it impossible for mobile phone snapshots to go around freely between networks or from one phone to another, but the adoption of more capable standards is on its way.

One the other hand one should state that the trend towards selling more and more camera-enabled phones is somewhat artificial, as it is still sustained by manufacturers; a camera crowded into a mobile phone is completely impractical when needing more than just taking snapshots.

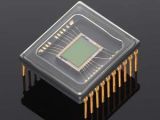

Digital cameras are expected to move along their way, the image quality being expected to get closer and closer to movie quality. In the future one might expect more megapixels, better calibrated and less noisy sensors, smaller sizes, more capabilities and lower manufacturing costs and sale pricing.

*Thanks to mr. fred for the information provided.

RESURSE

14 DAY TRIAL //

14 DAY TRIAL //