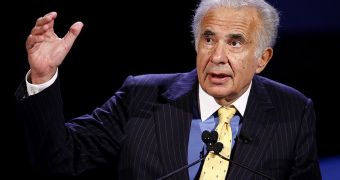

Wall Street top dog Carl Icahn is again pressing Apple to do a stock buyback in an effort to increase profits for shareholders, including himself.

In an interview with TIME, Icahn confirmed he’d sent a letter to Apple’s board of directors late last month urging investors to vote for a stock buyback program.

The billionaire investor doesn’t consider his proposal an indictment, saying, “Tim Cook is doing a good job with the business. I think he’s good whether he does what I want or not. [But] Apple is not a bank,” he said, referring to the company’s $150 billion (€110 billion) cash pile.

“I’m not against the management of this company. But they’ve got too much money on their balance sheet,” Icahn added.

Apple, for its part, responded to TIME’s query stating, “Earlier this year we more than doubled our capital return program to $100 billion [€73.4 billion], including the largest share repurchase authorization in history.”

“As part of our regular review process, we are once again actively seeking our shareholders’ input on our program, and as we said in October, the management team and our board are engaged in an ongoing discussion about it which is thoughtful and deliberate.”

“We will announce any changes to our current program in the first part of calendar 2014,” said Apple spokesperson Steve Dowling.

Editor’s note There are some reports interpreting Icahn’s words as positive, rather than an aggressive pursue to change Apple’s modus operandi.

But cooler heads seem to believe Icahn is (obviously) pursuing his own gain, and while he’s clearly done his homework, Apple is playing hard to get. I’m no expert but I think Apple, had it wanted to buy back its stock, would have done so on its own terms long before Icahn took a multi-billion-dollar position in the company.

14 DAY TRIAL //

14 DAY TRIAL //