ifoAppleStore, the site dealing exclusively with news and information about Apple's retail stores, reports that the current United States credit crisis is unlikely to affect the expansion of the giant’s retail initiative. In fact, it is believed that the crisis offers opportunities for Apple’s real estate team in the form of less-expensive property leases.

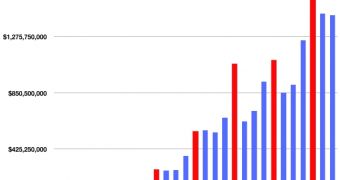

Apple has opened around 40 stores each year since the first were set up in May 2001. By analyzing the company’s financial statements, researchers have determined that the unavailability of credit and the government’s remedies may actually spell success for Apple’s real estate team. “The only downside to Apple’s plans,” ifoAppleStore notes, “may be any consumer spending downturn that results from bankruptcies and other company failures”.

The credit crisis is mostly affecting the real estate market, analysts say. In particular, the commercial segment that includes shopping and retail centers is being dragged down. Apple has many of its stores set up in such developments. However, according to a Wall Street Journal piece, developers have kinda overbuilt during the past eight years, and may now be forced to drop future mall plans, or discount existing spaces to attract retailers.

“For retailers, the glut can have an upside: cheaper rents, shorter lease terms and fatter allowances from landlords for outfitting stores,” says the WSJ. This is where Apple’s winning recipe, combining its cash reserves and the glamour of its stores, “could provide an advantage in negotiating lower lease costs or other benefits,” ifoAppleStore reports.

“The company is depending upon its up-scale properties and long-term leases to maintain financial performance in the coming year,” the report goes on to mention. But, as always, there's also a downside to the whole situation. Analysts are also taking into account that, as General Growth sells off its properties, Apple's value may plummet, probably even facing a take-over by other companies.

But what can be considered as Plan C for Apple is its ability to outperform the rest of the industry, analysts add. As the same report outlines, the retail stores are always jammed with customers, especially during the holidays.

14 DAY TRIAL //

14 DAY TRIAL //