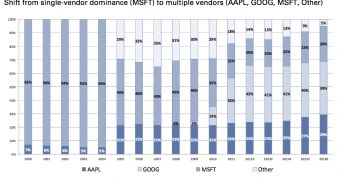

A startling disclosure (for some) made by Goldman Sachs this month – Microsoft’s true market share in the computer industry is just 20%. Apple has 24 percent of the computer market, which includes all types of computing devices from iPads to full-fledged PCs.

Because Microsoft has been slow to innovate in all the key areas (mostly mobile) these past few years, its market share in the computing industry as a whole has plummeted.

People still refer to the Redmond software company as the leader in computing, but the reality is that competitors like Apple and Google have put the kibosh on its world domination plans.

A Goldman Sachs report says the consumer computer market is now led by Google’s Android operating system with 42 percent share.

Apple comes in second with 24 percent, and Microsoft takes the third spot with 20 percent of the consumer compute market, according to The Seattle Times.

In other words, Apple – with its iOS and OS X operating systems installed on hundreds of millions of devices worldwide – now officially has a bigger install base than Microsoft.

Analysts at Goldman Sachs believe “Microsoft faces an uphill battle (though not insurmountable) given it lacks meaningful share in either tablets or smartphones and as such will need to rely on its appeal to knowledge workers to help drive adoption as its complement ecosystem will remain behind the iOS and Android platforms at least over the next 6-12 months.”

The investment bank also points out that next year will be “a critical period of adoption for the company.”

“… we expect the shares to stay relatively range bound near-term, and then, based on the adoption of its new compute SKUs, we would expect heightened volatility post a conclusion on whether Microsoft will be a true competitive platform to current compute leader Apple,” reads the research note.

Goldman Sachs mentions Smart TVs as “the next potential catalyst for disrupting current market dynamics,” naming Apple’s own set-top box as a potential disruptor.

14 DAY TRIAL //

14 DAY TRIAL //