AOL has revealed its third quarter financial results, painting a mixed picture. While there were some upsides, things are getting worse at the once mighty web company. Revenue was down, year-over-year and, while profits surged they were mostly due to sales of several assets.

"AOL is working hard to redefine the consumer experience on the internet,” Tim Armstrong, Chairman and CEO of AOL, said.

“In Q3, AOL continued on the path towards better health through targeted acquisitions and smart dispositions, meaningful product improvements, site relaunches, and strategic partnerships, all of which will enable us to execute more quickly against our strategy,” he added.

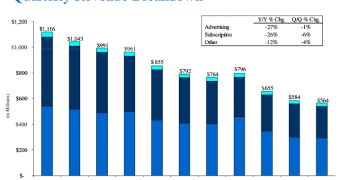

Overall revenue was down 26 percent from last year, when it was still a part of Time Warner. AOL brought in $563.5 million in Q3 2010 compared to $763.9 million in the same period in 2009.

Broken down, all revenue sources saw big declines. Subscription revenue, from its aging dial-up business, was down 26 percent to $244.8 million in Q3 2010. This is due to losing 24 percent of its subscribers in the past year.

However, the thing that was supposed to save AOL, advertising revenue, has actually dropped more, by 27 percent, down from $402.3 million to $292.8 million this year.

Display advertising fell only 8 percent in the third quarter in the US, but this was during a resurgence in display ad spending. Overall, display ad revenue was down 14 percent.

Net income on the other hand grew by 132 percent in Q3 from the previous year to $171.6 million. However, most of this was due to the sale of the ICQ instant messaging service to the Russian DST, now Mail.ru Group, and the sale of AOL's stake in Kayak, the travel company.

AOL also reported that its three acquisitions from the last quarter, TechCrunch, 5min Media and Thing Labs ended up costing AOL $97.1 million with a further $23.1 million to be paid out over the next three years in compensations.

14 DAY TRIAL //

14 DAY TRIAL //